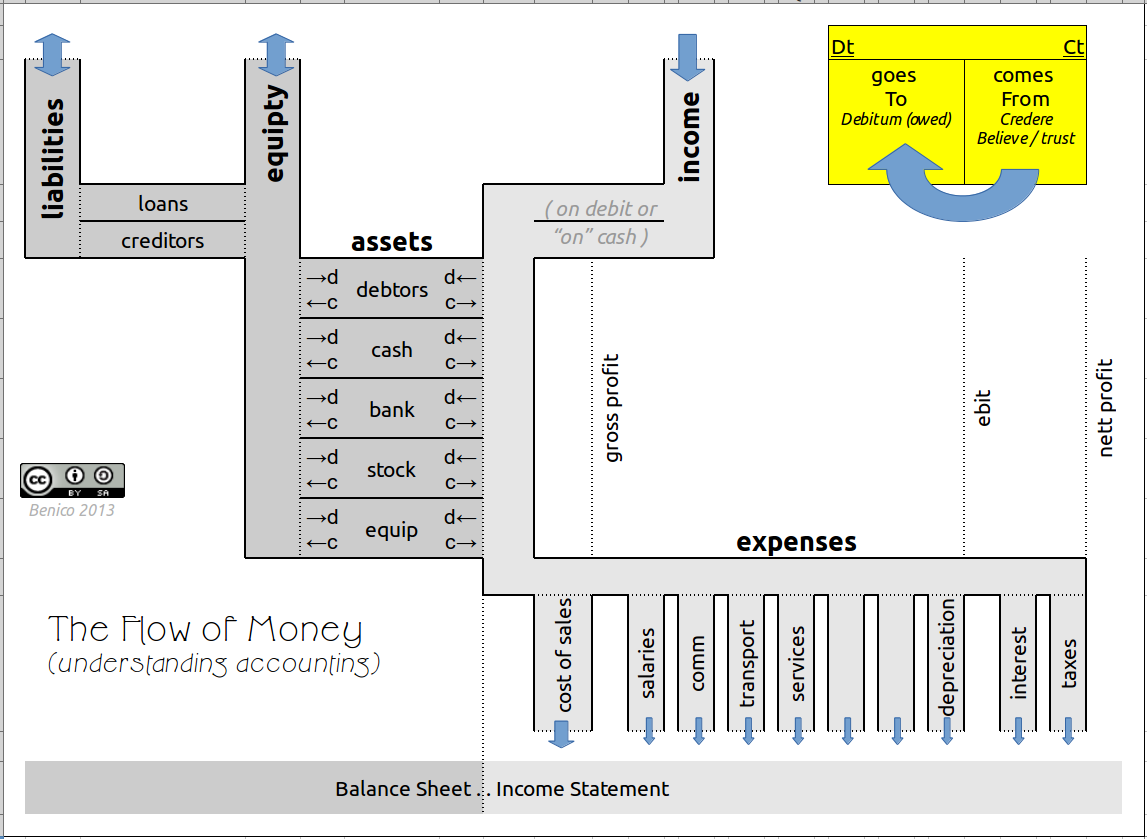

The picture above explains how the flow of money works in when a business is in trading.

What about VAT?

VAT is actually not part of a business. It is tax that we collect on behalf of the government. We just have to keep it in a separate box until they collect it.

The story goes like this: On each sale that we make - we must charge the client 15% tax and keep it in a box called "tax collected". We owe this money to the government.

On the other hand, if we buy things, and are being taxed - we have to recover this tax from the government. We keep this in a "tax paid" box.

At the end of the day we compare the "tax collected" box with the "tax paid" box and just settle the balance.

It never enters our income or expense system. It only uses our asset liability system - with the effect that it always balances out to zero. This is because all assets (tax collected) is equal to the liability (tax owned).

Money Pipes

The flow of money in an accounting system can be compared to a pipe network. Below is an example of a money flow pipe network for a typical small business.

This was Concept 4.

If you are curious to see what is lying around in the Downloads Bin >>> Click HERE:

for Downloads

Click here for About & Contact

This page is designed for a cell phone. If you view this on a computer or laptop - then kindly un-maximize the window and reduce the width of your browser-window to a portrait shape.

MoneyFlows by Benico van der Westhuizen is licensed under a

Creative Commons Attribution 4.0 International License